Are you aware of the true value of your customers? If not, it’s time to sit up and take notes. Understanding your customer’s lifetime value (CLV) is crucial for any business looking to succeed in today’s competitive market. It enables you to make informed decisions about how much money and resources you should invest in acquiring and retaining customers and predict future revenue streams. In this blog post, we’ll explore why knowing your customer’s lifetime value is critical to business success and how it can help drive growth and profitability in the long run. So buckle up, grab a coffee, and let’s dive into the world of CLV!

Lifetime Customer Value (LCV) is a metric that quantifies a customer’s total value over their relationship with a business. In other words, it measures how much revenue a customer generates for a company while they continue to do business with that company.

Many factors contribute to a customer’s lifetime value, including how often they purchase, how much they spend per transaction and their overall satisfaction with the product or service. Additionally, LCV can be affected by things like customer churn (the rate at which customers stop doing business with a company) and referral rates (the rate at which customers refer others to the company).

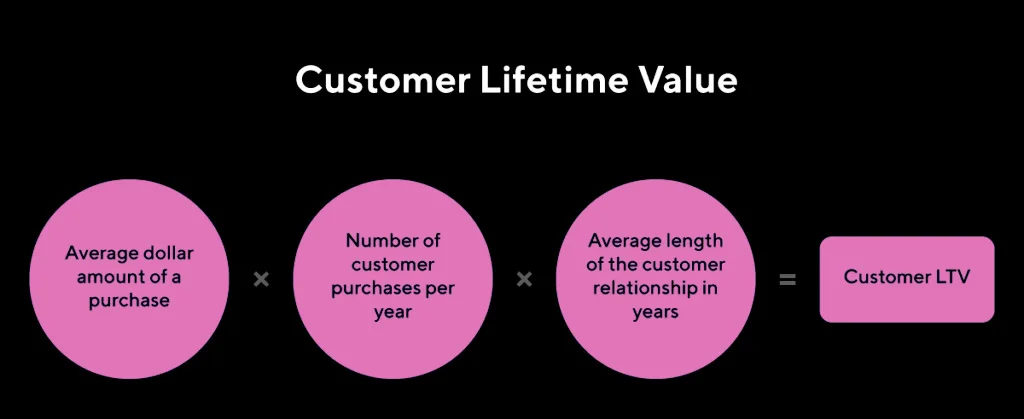

There are a few different ways to calculate CLV, but the most common method is to take the average purchase amount and multiply it by the number of transactions a customer makes over their lifetime.

For example, let’s say the average purchase amount at your store is $50 and each customer makes an average of 10 purchases over their lifetime. In this case, your customers’ CLV would be $500.

Knowing your customers’ CLV is vital because it allows you to make informed decisions about how much you can spend on marketing and acquisition costs. If your acquisition costs are higher than your customers’ CLV, you’re losing money on each new customer you acquire.

On the other hand, if you understand your customers’ Lifetime Value well, you can make strategic decisions about where to allocate your marketing budget to get the most bang for your buck. For example, suppose you know that each new customer acquired through paid advertising costs $100 but has a Lifetime Value of $500. In that case, it’s worth it to continue investing in paid advertising since you’ll profit from each new customer.

You should start now if you’re not already tracking your customers’ Lifetime Value.

As a business owner, knowing your customer’s lifetime value (LCV) is critical. Why? Because it directly impacts your company’s bottom line. If you don’t know your LCV, you could be making decisions that are costing you money – and you may not even realize it.

Here are some of the benefits of knowing your customer’s lifetime value:

1. Make More Informed Marketing Decisions

When you know your LCV, you can make more informed marketing decisions. You can allocate your marketing budget more effectively and target your marketing efforts to customers most valuable to your business.

2. Improve Customer Retention Rates

Another benefit of knowing your LCV is that it can help you improve your customer retention rates. If you know how much each customer is worth to your business, you can invest more in keeping them happy and loyal. This includes things like providing excellent customer service and offering incentives for repeat business.

3. Make Better Pricing Decisions

Knowing your customer’s lifetime value can also help you make better pricing decisions. If you know how much each customer is worth to your business, you can charge more for products and services without fear of losing them to a competitor. Of course, this only works if you offer a superior product or service at a fair price. But if you do, then charging a premium price is a viable option.

As the owner of a business, it is critical that you know your customer’s lifetime value (LCV). Why? Because this number represents the total revenue, your company will earn from a single customer over their lifetime. The higher the LCV, the more valuable that customer is to your business.

There are many strategies you can use to increase your customer’s LCV. Some of these include:

There are a few common mistakes that business owners make when calculating their customer’s lifetime value. First, they often fail to consider the time value of money. This means that they don’t factor in things like inflation or interest rates, which can significantly impact the amount of money a customer is actually worth to the business.

Another mistake is failing to account for all the revenue streams a customer may generate. For example, a customer may not just make purchases from your company, but they may also refer other customers or provide valuable feedback that helps you improve your products or services.

Businesses sometimes make the mistake of assuming that all customers are equally valuable. However, this is rarely the case. Some customers will be more valuable than others based on factors like how often they purchase, how much they spend, and whether they’re likely to refer other customers. By taking these factors into account, you can get a more accurate picture of your customer’s lifetime value.

There are several ways to measure and analyze a customer’s lifetime value (LCV). Some standard methods include:

-Calculating the present value of future cash flows: This approach calculates the LCV as the sum of all future cash flows from the customer, discounted back to the present.

-Estimating customer lifetime revenue: This approach estimates the LCV as the total revenue a customer is expected to generate over their lifetime.

-Modeling customer behavior: This approach uses statistical modeling techniques to predict how customers will behave over time and estimates the LCV based on these predictions.

Each of these methods has its own strengths and weaknesses, so it’s important to choose the right one for your particular needs.

Knowing your customer’s lifetime value is essential to running a successful business. It allows you to understand your customers’ behavior better, track their spending over time, and optimize your marketing efforts. With this knowledge, you can effectively allocate resources toward activities that will bring in more revenue and build lasting customer relationships. By leveraging the power of customer lifetime value, businesses can maximize their return on investment and ensure long-term success.

Need an extra hand with analyzing your CLV or any other customer metrics? Our analytics team can help. Get in touch if you’ve got any further questions, and we’ll happily set up a chat.